Consumer Sentiment in Saudi Arabia: Trends of Hope and Growth

Discover how data-driven decision-making is revolutionizing brand health tracking in the MENA region. Learn how leveraging real-time insights can help businesses stay competitive, improve customer loyalty, and adapt to evolving consumer expectations.

Get the complete consumer intelligence report

Download our comprehensive guide with detailed insights, case studies, and actionable strategies for your industry.

Join our community • Valuable insights • Unsubscribe anytime

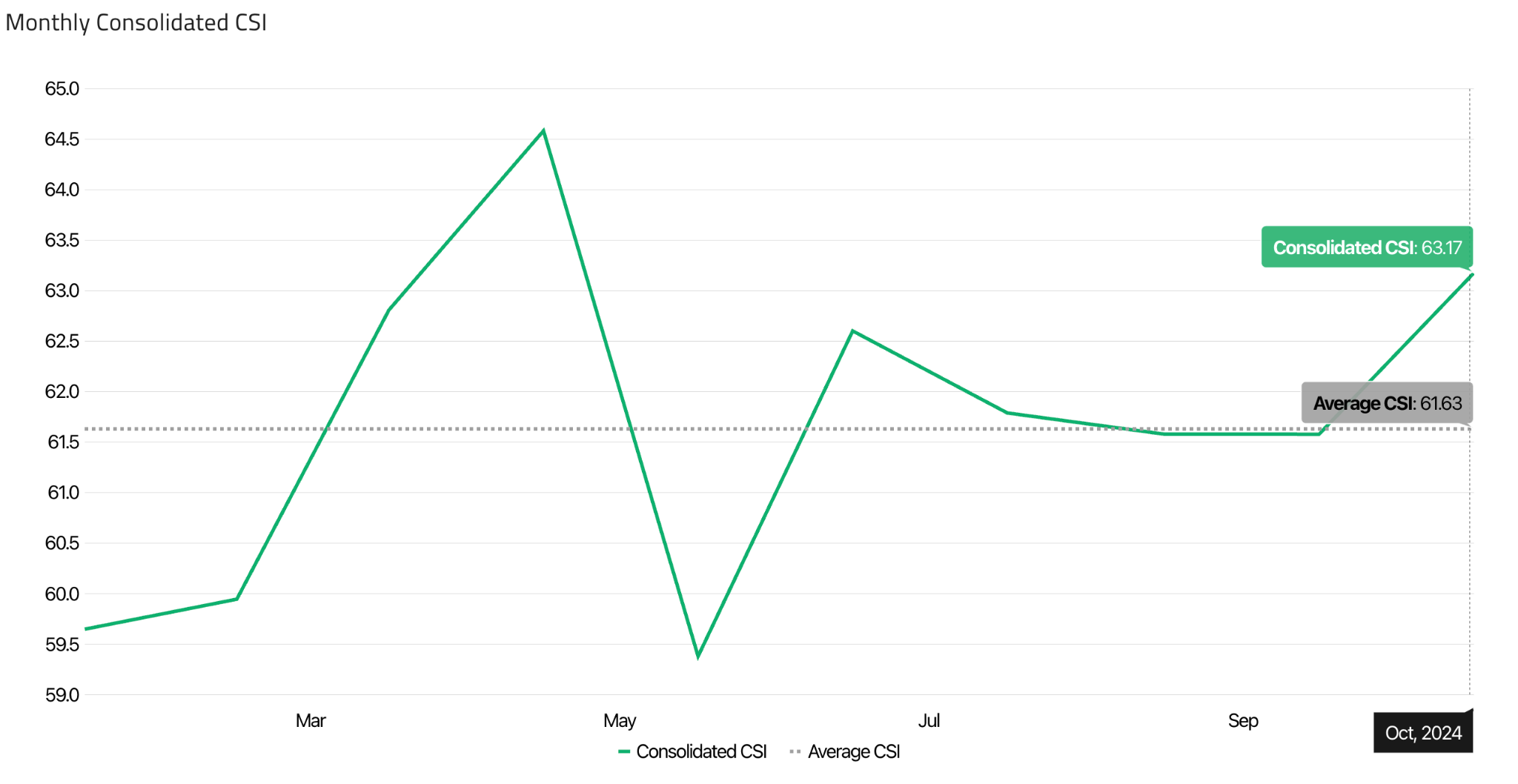

Overall Consumer Sentiment (CSI Index: 61.63)

The latest CSI for Saudi Arabia registers at 63.17, recovering from 59.38 the previous month and approaching its April peak of 68.47. This 6.4% increase underscores renewed consumer optimism in Saudi Arabia. Saudi consumers exhibit dynamic engagement, encouraging businesses to innovate and meet their evolving preferences. This resilient consumer sentiment highlights the potential for growth as firms introduce offerings that resonate with an increasingly selective audience.

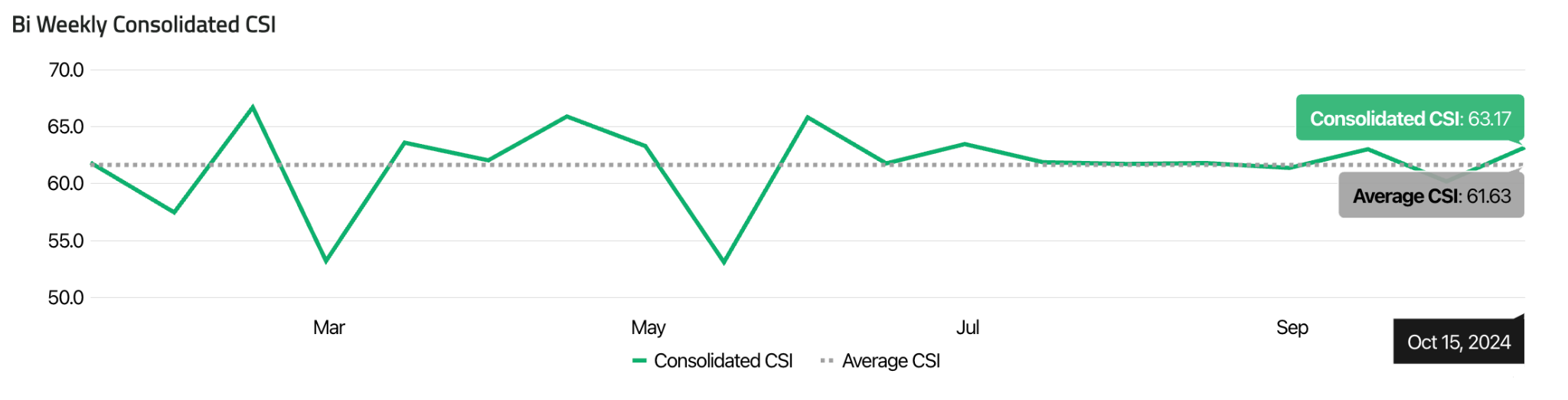

Consolidated Monthly and Bi-Weekly CSI Trends: Renewed Optimism

Bi-weekly CSI fluctuations between 53.20 and 66.68 also reflect a landscape of both challenges and opportunities, spotlighting Saudi consumers' adaptability to market conditions. This data marks significant sectoral successes, especially in retail and services, while highlighting the importance of continual alignment with consumer needs.

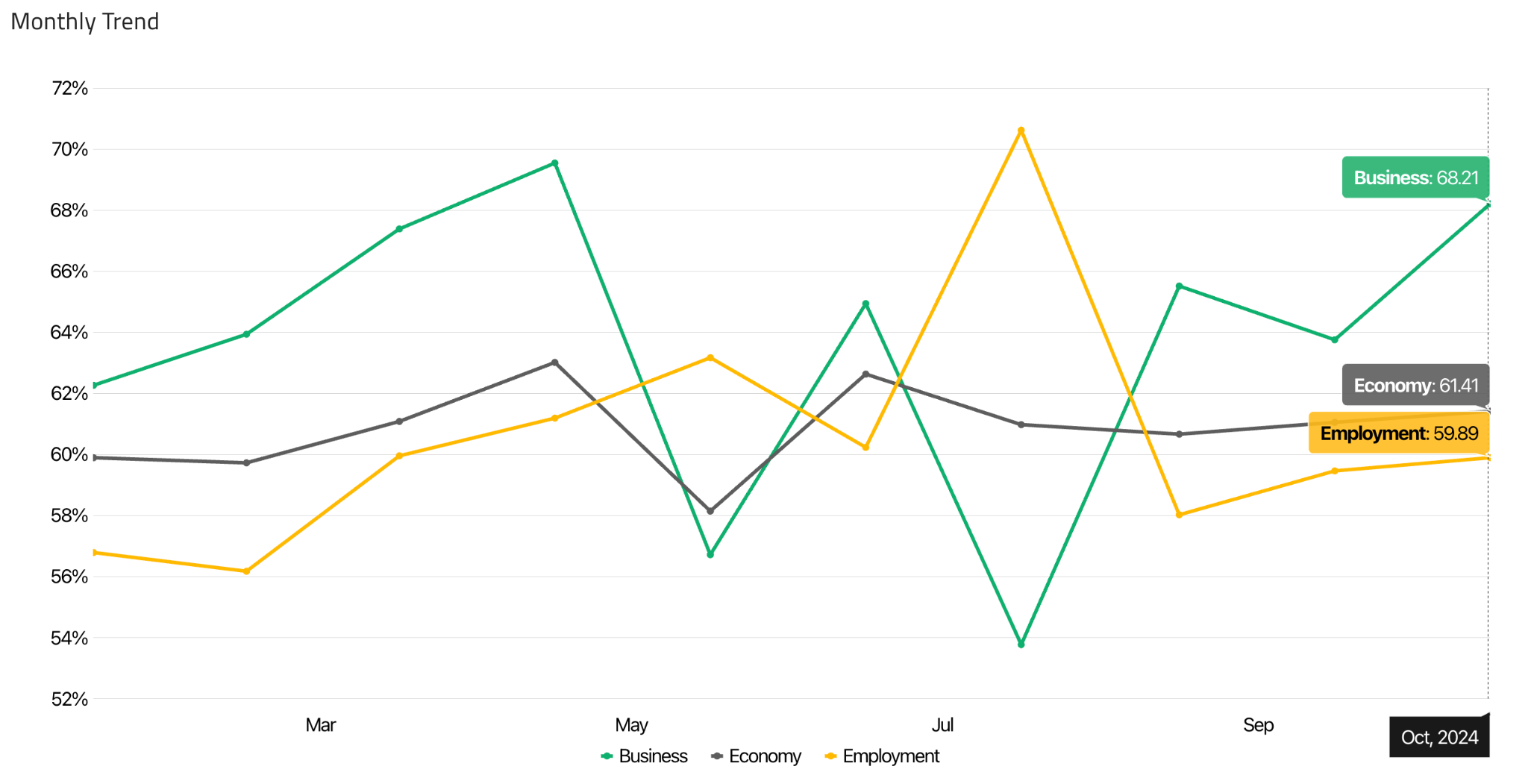

Employment and Economic Indicators: Strengthening Consumer Power

Employment statistics demonstrate continued strength, with the Employment Sentiment Index ranging from 49.95 to 76.67. These numbers indicate a solid workforce, particularly in the private and industrial sectors. The sustained growth of mega-projects like Neom and others has driven new employment opportunities, helping boost household incomes and consumer spending power. The Purchasing Managers' Index (PMI) for Saudi Arabia stood at 56.3 in September 2024, an indicator of expansion in the non-oil private sector, particularly in services and retail (Source: Argaam). While employment sentiment remains stable, with modest growth in confidence after a sharp increase in August. This PMI growth also marks a 1.2% rise from the previous month, reflecting consistent demand for products and services. Furthermore, employment growth within the private sector has extended for 16 consecutive months, reinforcing the optimism in consumer sentiment (Source: Arab News).

This PMI growth also marks a 1.2% rise from the previous month, reflecting consistent demand for products and services. Furthermore, employment growth within the private sector has extended for 16 consecutive months, reinforcing the optimism in consumer sentiment (Source: Arab News). Comparative Trends: A Landscape of Opportunity

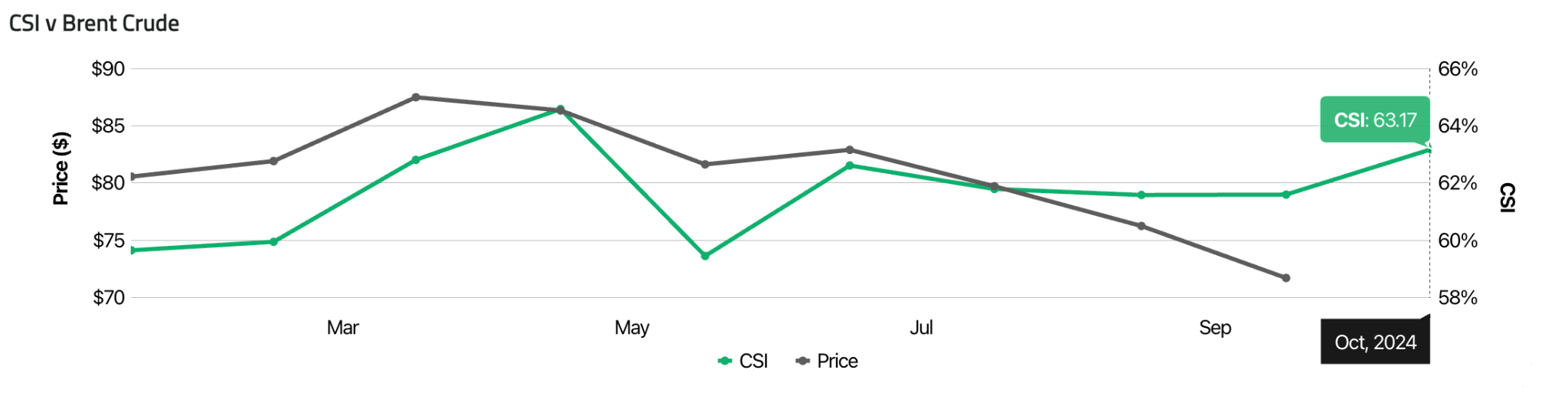

Despite fluctuations in Brent oil prices, Saudi Arabia's economy remains resilient, with non-oil GDP growth driving overall momentum. GDP growth for Q1 2023 stood at 3.9%, largely powered by the non-oil sector, which saw a 5.8% rise (Source: Argaam). The Kingdom's diversification efforts continue to insulate the economy from the volatility of oil markets, allowing businesses to maintain competitive pricing and innovate with confidence. Inflation has remained subdued, with input prices experiencing minimal increases of +0.3%, enabling firms to keep their costs stable and protect profitability (Source: Arab News). This economic stability further boosts consumer sentiment, providing brands with an opportunity to introduce new products and services at attractive price points.

Inflation has remained subdued, with input prices experiencing minimal increases of +0.3%, enabling firms to keep their costs stable and protect profitability (Source: Arab News). This economic stability further boosts consumer sentiment, providing brands with an opportunity to introduce new products and services at attractive price points. Conclusion

Saudi Arabia’s consumer sentiment signals a vibrant market of promise and resilience. Despite short-term fluctuations, the broader economic outlook remains positive, supported by solid employment, diversified growth, and an optimistic consumer base. Businesses that adapt their strategies to these dynamics are positioned to capitalize on the Kingdom’s steady progression toward Vision 2030. As Saudi Arabia advances, brands have a unique opportunity to connect with confident, engaged consumers, creating lasting value within a dynamic and expanding marketplace. Note: Don’t miss out! Our monthly newsletter is coming in two weeks, with detailed insights, and data to help you navigate the landscape. Subscribe now to stay informed and gain a deeper understanding.References:

Related Articles

Continue exploring insights on similar topics

From Bento Boxes to a $3.1B opportunity: how TrueTrends decoded the school lunchbox revolution

Explore how Sila's TrueTrends uncovered 2025 school lunchbox trends, cultural fusion meals, and a $3.1B growth opportunity for brands.

The MENA Trend Effect: Watch closely, it grows fast.

MENA Trends: How Dubai’s pistachio chocolate trend shows MENA’s power to create, amplify, and globalize what’s next in food, and culture.

Consumer Analysis: What to Expect This Eid Al Adha in MENA Markets

Discover Eid Al Adha 2025 consumer trends in MENA. $300B GCC market growth, 41% online shoppers, and key spending patterns revealed

Ready to Transform Your Consumer Intelligence?

Discover how Sila's AI-powered platform can help you understand your customers better and drive growth.