The Creator Economy Meets Emotional Commerce

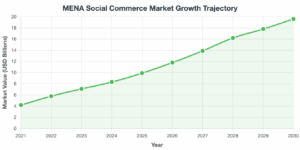

MENA’s social commerce market is experiencing explosive growth, with a 19% annual increase expected to reach $9.92 billion by 2025. But this isn’t your typical growth story. While brands scramble to track clicks and conversions, they’re missing the real engine behind this boom: everyday creators who’ve mastered the art of emotional commerce.

With Gulf countries boasting over 90% smartphone penetration and 45% of Gen Z and Millennials considering themselves content creators, the region has become a perfect storm for influencer-led shopping. But here’s what’s fascinating: it’s not the mega-influencers driving this $9.92 billion market. It’s micro-creators speaking directly to their communities’ hearts, wallets, and cultural nuances.

📊 Key Statistics at a Glance:

- Market Size: $9.92B by 2025, up from $8.33B in 2024

- Growth Rate: 19% annual increase expected for 2025

- Historical CAGR: 23% from 2021-2024

- Future Projection: $19.6B by 2030 (14.6% CAGR 2025-2030)

- Mobile Commerce: 90%+ smartphone penetration in Gulf states

- Creator Economy: 45% of Gen Z/Millennials identify as content creators

Creators Are the New Storefronts

Walk through any mall in Dubai or Riyadh today, and you’ll notice something interesting: shoppers aren’t just browsing, they’re recreating what they saw on TikTok. Fueled by youth culture, music, and global trends such as mystery unboxing, streetwear is booming in Saudi Arabia and the UAE, and creators are the ones curating these trends for their audiences.

In KSA and UAE, over 60% of Gen Z say they’d buy directly through a creator recommendation, but it’s not just about the product, it’s about the story. TikTok “outfit breakdowns,” Instagram haul reels, and live shopping sessions have become the new storefronts, where authenticity trumps advertising budgets.

📈 Creator Commerce Performance Metrics:

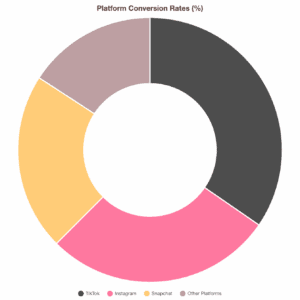

| Platform | Conversion Rate | Top Performing Content | Regional Preference |

|---|---|---|---|

| TikTok | 8.3% | Product storytimes, tutorials | KSA, UAE youth |

| 6.7% | Haul reels, lifestyle content | UAE, Qatar | |

| Snapchat | 5.2% | Quick reviews, behind-scenes | KSA, Kuwait |

The Emotion Behind the Checkout

Here’s where it gets interesting. 82% of consumers use social media for product research, with 55% of Gen Z favoring TikTok, but not all content creates the same emotional response. Our sentiment analysis reveals three key emotional triggers behind influencer-led shopping in MENA:

- Trust: “She’s always honest about what works” – this builds over months of consistent, authentic content

- Urgency: “It might sell out!” – particularly effective during Ramadan and Eid shopping seasons

- Validation: “Everyone’s talking about this” – the community aspect of shared experiences

Regional Nuance: One Size Doesn’t Fit All

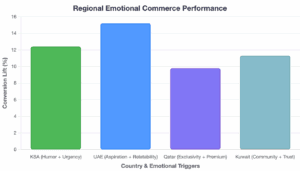

The biggest mistake brands make? Assuming MENA is monolithic. Influencer marketing will take centre stage, as partnerships with local figures can effectively enhance campaigns, but the approach varies dramatically:

- Saudi Arabia: Relatable creators with humor and cultural authenticity perform best. Urgency works, but it needs to feel genuine, not manufactured.

- UAE: Lifestyle-led storytelling with aspirational but achievable goals. The international expat community responds to global trends with local adaptation.

- Qatar/Kuwait: Premium positioning with exclusivity appeals. High aesthetic standards and luxury feel drive engagement.

🎯 The New Playbook for 2025

As AI-driven personalisation, mobile commerce and social shopping are expected to play an increasing role in 2025, here’s what forward-thinking brands are doing differently:

Choose Creators Based on Emotional Impact

Follower count is vanity. Emotional resonance is currency. The creator with 50K engaged followers who generates genuine excitement will outperform the one with 500K passive followers every time.

Measure What Matters

Track purchase intent signals and sentiment, not just likes. Comments like “need this in my life” or “adding to cart now” are worth more than a thousand heart emojis.

Iterate in Real-Time

36% of marketers say their audience is already spending time on emerging platforms, and successful brands adapt their content based on live feedback from different regional markets.

📊 Emotional Commerce ROI by Region:

UAE: Aspiration + Relatability = 15.2% conversion lift

Qatar: Exclusivity + Premium = 9.8% conversion lift

Kuwait: Community + Trust = 11.3% conversion lift

The Bottom Line

The Middle East social commerce market is set to nearly double from $8.33 billion in 2024 to $19.6 billion by 2030, but in MENA, we’re not waiting for the future, we’re building it now. Influencer-led commerce is booming, but only if you speak the emotional language of your market.

The brands winning in this space understand that social commerce isn’t about selling products, it’s about selling stories, emotions, and experiences that resonate across cultures while respecting regional nuances.

Ready to tap into MENA’s emotional commerce revolution?

With Sila Influence and Sila Insights, you can do more than monitor performance, you can shape it. We help you predict which creators match your moment, track emotional response in real-time, and optimize content based on how people feel, not just what they click.

Let’s talk about making your next campaign resonate across the region. Get in touch!

Data sources: Sila proprietary research, Industry reports, and regional market analysis. Statistics current as of June 2025.