Understanding Consumer Sentiment Changes: UAE & KSA Q1 2025

Consumer sentiment insight from UAE and KSA: A comparative analysis of Q1 2024 vs Q1 2025 using Sila Insights' CSI framework

Get the complete consumer intelligence report

Download our comprehensive guide with detailed insights, case studies, and actionable strategies for your industry.

Join our community • Valuable insights • Unsubscribe anytime

Introduction

Consumer sentiment serves as a vital indicator of economic health, influencing spending patterns and business decision-making. In the GCC region, the United Arab Emirates and Saudi Arabia represent two of the most significant economies, each with distinct development trajectories and economic diversification strategies. Understanding how consumer confidence has evolved in these markets provides crucial context for strategic planning and market entry decisions.

This comparative analysis leverages Sila Insights' comprehensive Consumer Sentiment Index (CSI) data, which combines multiple sentiment indicators into a consolidated monthly score. By examining changes in these scores, we can identify meaningful trends and anticipate potential shifts in consumer behaviour across these influential markets.

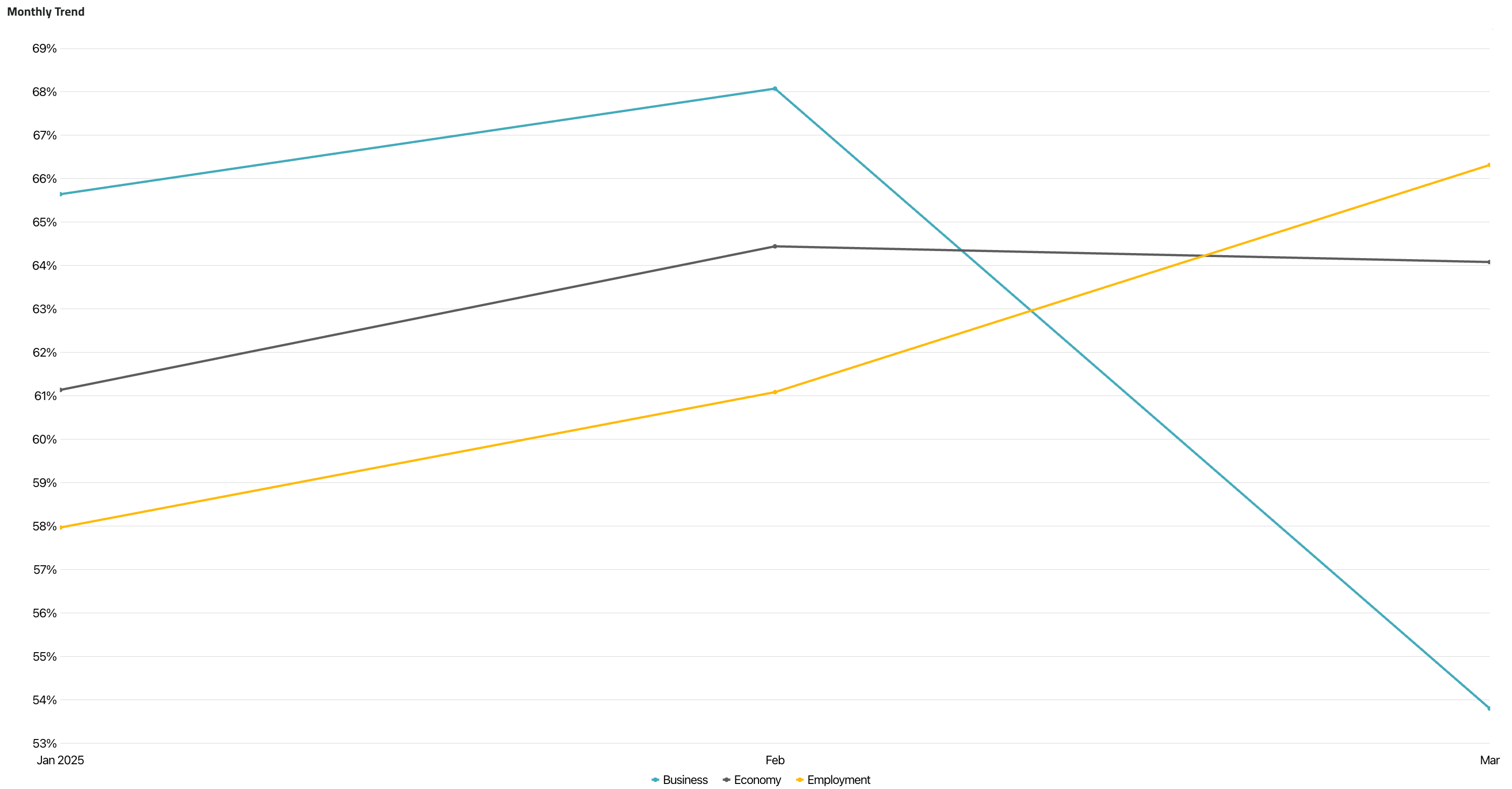

Key Findings: Saudi Arabia

Overall Sentiment Trajectory

Saudi Arabia's consolidated CSI showed promising growth in early 2025, reaching a peak of 64.54 in February 2025. However, March 2025 revealed a 6.8% MoM decline to 60.12, bringing sentiment levels back to values similar to early 2024. This recent pullback suggests a recalibration of consumer expectations, potentially influenced by global economic developments and political uncertainties.

Component Analysis

Business Sentiment: The Business Index in KSA showed strong performance in early Q1 2025, with scores of 65.65 and 68.08 in January and February respectively. However, March 2025 saw a decline to 53.80, representing a 20.9% drop from February. This substantial month-on-month decrease suggests a significant reassessment of business conditions in the latter part of Q1 2025.

Economic Sentiment: Economic confidence in KSA demonstrated resilience through February 2025, reaching 65.22, but experienced a slight dip to 64.08 in March 2025. This 1.7% MoM decrease, while modest compared to other indices, indicates potential caution regarding the Kingdom's economic outlook amid recent global developments.

Employment Sentiment: The Employment Index reached 61.09 in February 2025 before increasing to to 66.32 in March 2025, representing a 4.3% MoM increase. This means employment sentiment remained the strongest component of KSA's consolidated CSI, reflecting continued confidence in job prospects and employment stability.

Sentiment Distribution

Raw sentiment data reveals a notable increase in March 2025, with positive sentiment expressions rising to 668, up from 528 in February 2025, a 26.5% MoM increase. This surge in positivity contrasts with the dip in the Business Index and Consolidated CSI, suggesting a more nuanced consumer mood not fully captured by index scores.

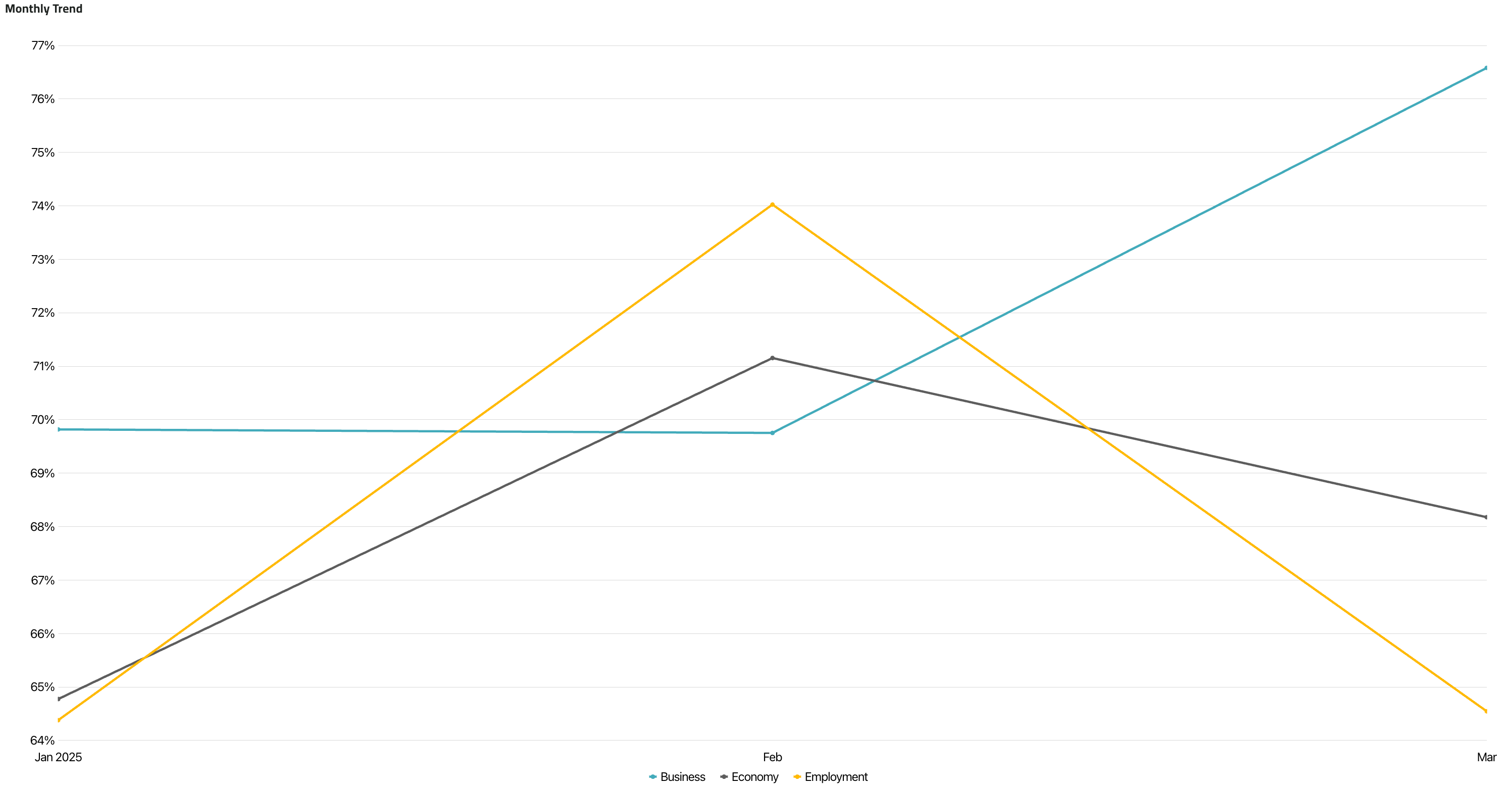

Key Findings: United Arab Emirates

Overall Sentiment Trajectory

The UAE maintained strong consumer sentiment through February 2025, with the consolidated CSI reaching 71.64. However, March 2025 saw a significant decline to 67.89, representing a 5.2% MoM decrease. This downward trend mirrors developments in Saudi Arabia, suggesting regional or global factors affecting consumer confidence across the Gulf markets.

Component Analysis

Business Sentiment: The Business Index in the UAE showed remarkable resilience, growing from 72.15 in February to 76.58 in March 2025, representing a 6.1% MoM increase. This counters the overall downward trend and suggests continued business optimism despite broader economic concerns.

Economic Sentiment: Economic sentiment in the UAE displayed notable volatility in Q1 2025. After reaching 71.15 in February, March saw a decline to 65.38, representing a 8.1% MoM decrease. This drop indicates heightened consumer concerns about global economic developments.

Employment Sentiment: The Employment Index exhibited the most dramatic fluctuation in the UAE, peaking at 74.02 in February before going down to 64.55 in March 2025, a 12.8% MoM decline. This reduction suggests rapidly changing employment expectations amid economic adjustments and global uncertainties.

Sentiment Distribution

Raw sentiment data from the UAE shows a decline in positive expressions from February to March 2025 (532 to 483), representing a 9.2% MoM decrease. This aligns with the downward trend in the consolidated CSI and most component indices, particularly in economic and employment sentiment.

Comparative Analysis: KSA vs. UAE

Sentiment Convergence

A notable finding from the comparative analysis is the parallel downward trend in both markets during March 2025. This simultaneous decline suggests shared external factors influencing regional consumer confidence, potentially including global economic developments, trade disputes, and political uncertainties.

The UAE maintained its position as the regional leader in consumer sentiment, with a March 2025 consolidated CSI of 67.89 compared to Saudi Arabia's 60.12. However, the gap between the markets (7.77 points) remains relatively consistent with previous periods, indicating structural differences in consumer confidence between the two economies.

Contrasting Sector Strengths

The two markets display distinct patterns in their component indices:

- KSA: Demonstrated strongest resilience in the Employment Index, which experienced a milder decline (4.3%) compared to the Business Index (20.9%) in March 2025.

- UAE: Showed particular strength in Business sentiment, which actually improved in March 2025 while other indices declined, reaching 76.58, the highest component score observed in either market during Q1 2025.

Volatility Patterns

The UAE market showed significant volatility in sentiment metrics during Q1 2025, particularly in the Employment Index, which fluctuated substantially between January and March. Saudi Arabia displayed more consistent patterns in January and February 2025, before experiencing pronounced declines in March, especially in the Business Index.

Market Opportunities

Saudi Arabia

- Employment Services Growth: The decline in business sentiment in March 2025 represents an opportunity for business consulting services, operational efficiency solutions, and financial management tools to address emerging corporate concerns.

- Economic Confidence Leverage: Despite recent declines, the relatively strong employment sentiment suggests continued opportunities for recruitment platforms, professional development services, and HR technology providers.

- March Business Sentiment Recovery: The moderate decline in economic sentiment indicates potential for financial advisory services and investment education platforms to help consumers navigate changing market conditions.

United Arab Emirates

- Business Services Expansion: The growing business sentiment in March 2025 suggests continued receptiveness to business service offerings, corporate events, and B2B solutions despite broader economic concerns.

- Employment Volatility Response: The decline in employment sentiment presents opportunities for temporary staffing agencies, career transition services, and skills development platforms to address emerging workforce uncertainties.

- Economic Confidence Stabilisation: The drop in economic sentiment indicates potential for economic information services, financial planning tools, and consumer advisory services to help address growing economic concerns.

Conclusion

The analysis of consumer sentiment in Saudi Arabia and the UAE during Q1 2025 reveals a dynamic picture of evolving consumer confidence in two of the GCC's most significant economies. While both markets experienced downward trends in March 2025, the UAE maintains its position as the regional leader in consumer optimism, with Saudi Arabia demonstrating relative resilience in employment confidence despite broader concerns.

These findings highlight the immediate impact of recent global economic developments and political uncertainties on consumer sentiment in both markets. For businesses operating in or entering these markets, understanding these monthly sentiment trajectories provides crucial context for strategic planning and market positioning in a rapidly changing economic landscape.

This research was conducted using Sila Insights' proprietary Consumer Sentiment Index methodology and social understanding solutions. For more information on how Sila's advanced analytics can support your market research needs, please contact our team.

Related Articles

Continue exploring insights on similar topics

From Bento Boxes to a $3.1B opportunity: how TrueTrends decoded the school lunchbox revolution

Explore how Sila's TrueTrends uncovered 2025 school lunchbox trends, cultural fusion meals, and a $3.1B growth opportunity for brands.

The MENA Trend Effect: Watch closely, it grows fast.

MENA Trends: How Dubai’s pistachio chocolate trend shows MENA’s power to create, amplify, and globalize what’s next in food, and culture.

Consumer Analysis: What to Expect This Eid Al Adha in MENA Markets

Discover Eid Al Adha 2025 consumer trends in MENA. $300B GCC market growth, 41% online shoppers, and key spending patterns revealed

Ready to Transform Your Consumer Intelligence?

Discover how Sila's AI-powered platform can help you understand your customers better and drive growth.