Introduction

The Consumer Sentiment Index (CSI) is a crucial barometer of a region’s overall economic sentiment, reflecting consumers’ attitudes towards present and future economic conditions. As an index, it can offer significant insights into the economy’s health and potential future trends. In this article, we explore the consumer sentiment in Saudi Arabia for May 2023, complemented by additional economic indicators such as GDP growth and PMI data, to provide a comprehensive overview of the Kingdom’s economic landscape.

Overall Consumer Sentiment (CSI Index: 59, -13.3 from April)

In May 2023, the Overall Consumer Sentiment CSI Index for Saudi Arabia dropped to 59, a decrease from the previous month’s score. Despite this decline, the robust growth of the non-oil sector and the positive job market trends lend an optimistic outlook to the country’s economic future. Furthermore, the PMI for May rose above the critical 50-mark to 56.6, indicating an expansion in the non-oil private sector. This increase in PMI, coupled with the government’s efforts to diversify the economy away from oil, paints a positive picture for the future.

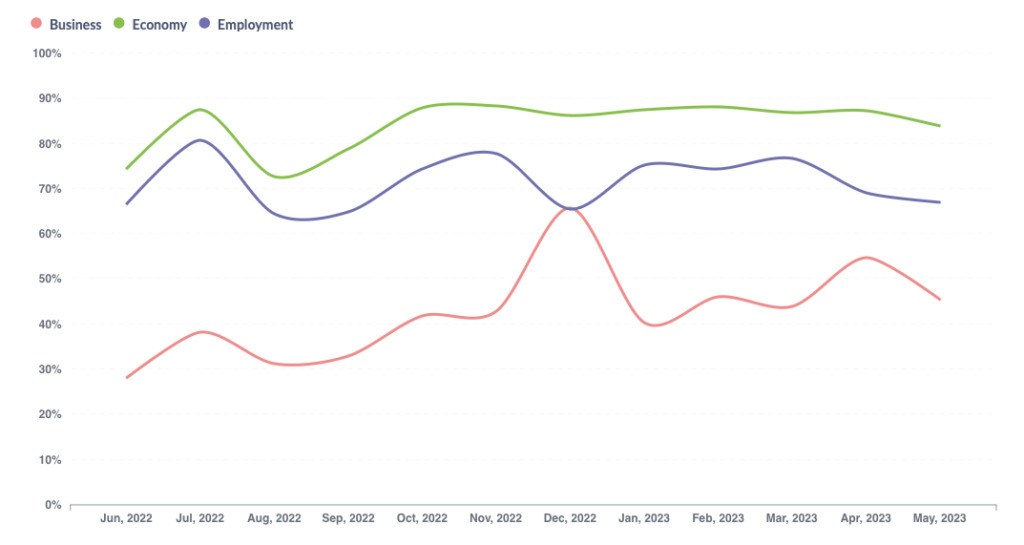

Economic Sentiment (CSI Index: 84, -3.5 from April)

The Economic Sentiment CSI Index for Saudi Arabia stood at 84 in May 2023, a slight dip from the previous month. This decline mirrors the mixed economic performance that Saudi Arabia experienced during this period. While the economy saw a 3.9% year-on-year growth in the first quarter of 2023, largely driven by non-oil activities, the growth was slower compared to the fourth quarter of 2022, when GDP grew by 5.5% year-on-year. The IMF has projected Saudi GDP growth to slow to 3.1% this year, which may have contributed to the public’s cautious economic sentiment. However, the robust growth in non-oil activities, which recorded a 5.8% increase in the first quarter, is a positive sign that points towards the success of Saudi Arabia’s diversification efforts.

Business Sentiment (CSI Index: 46, -9.1 from April)

The Business Sentiment CSI Index dropped to 46 in May 2023, reflecting consumers’ guarded outlook towards the business sector. Despite the decline, the non-oil private sector, particularly manufacturing, demonstrated resilience, as suggested by the positive PMI data. The PMI rose above 50, indicating expansion in the non-oil private sector. However, the broader business sentiment was likely negatively affected by the slowdown in the oil sector, which declined by 4.8% in the first quarter, and the announcement of a cut in oil output from May. These developments may have raised concerns about potential economic instability and contributed to the drop in the business sentiment index.

Employment Sentiment (CSI Index: 67, -2.0 from April)

The Employment Sentiment CSI Index slipped to 67 in May 2023, a slight decrease from April. Nevertheless, the job market exhibited encouraging signs. Hiring activity was highest in the industrial sector, driven by new jobs created through mega-projects such as Neom. The report also highlighted a rise in salaries, especially for mid-to-senior level professionals, with increases ranging from 20% to 30%. This positive trend in the job market, coupled with the nation’s ongoing Saudisation efforts, underscores a promising employment landscape that could potentially bolster the employment sentiment in the coming months.

Conclusion

While the CSI data indicates a cautious sentiment among consumers, the economic indicators paint a more nuanced picture. The growth in non-oil activities and the promising employment landscape, particularly in the industrial sector, are positive signs. Despite the decrease in the overall CSI in May 2023, the resilience of the non-oil sector, backed by encouraging PMI data, and optimistic job market trends signal a potentially robust economic future for Saudi Arabia. This analysis underscores the value of the CSI as a broad gauge of consumer sentiment, offering invaluable insights into Saudi Arabia’s economic trajectory.

However, it is important to remember that while the CSI provides a snapshot of consumer sentiment, it is just one piece of the larger economic puzzle. It must be interpreted in conjunction with other economic indicators for a holistic understanding of the economy. With its ongoing economic diversification efforts and strong fundamentals, Saudi Arabia remains a dynamic and evolving economic landscape.

If you’d like to have a dashboard and monthly deep-dive into MENA consumer sentiment produced by Sila’s technology and market research team, enquire below to speak to a member of our team and understand the true benefit of real-time consumer sentiment data.

Enquire about the Sila CSI

"*" indicates required fields